Tax avoidance via the Netherlands significantly reduced thanks to measures

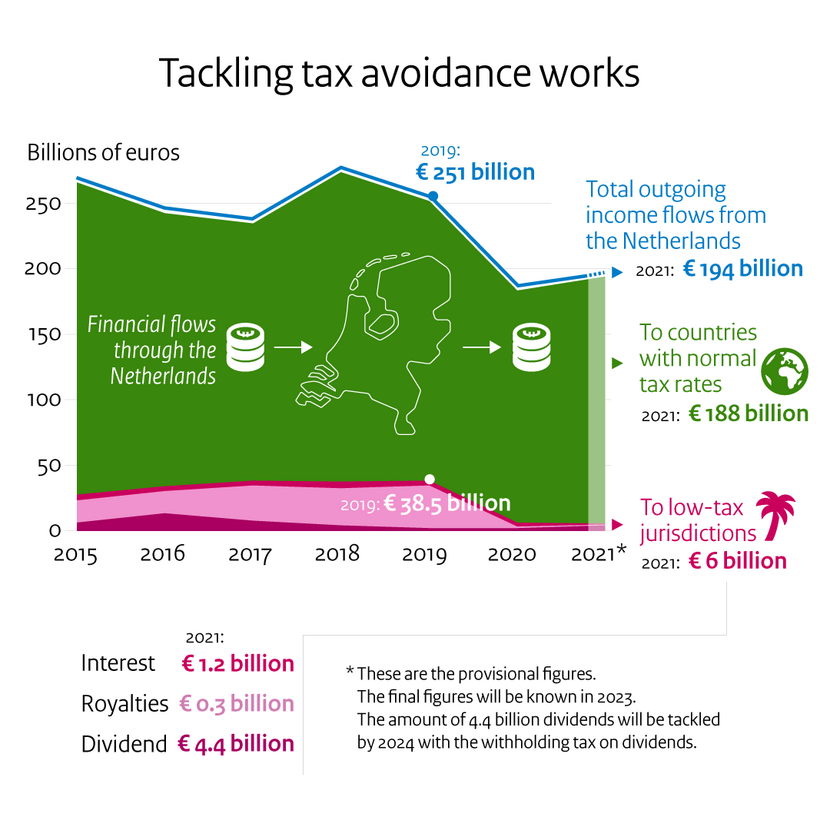

Thanks to the various measures introduced in recent years to combat tax avoidance, the flow of money from the Netherlands to countries with a low tax rate has significantly reduced. Based on provisional figures, the total flow of income to such countries has fallen by almost 85 per cent from €38.5 billion in 2019 to almost €6 billion in 2021. This is due to the outgoing interest and royalty payments to low-tax countries falling from €36.4 billion in 2019 to a provisionally estimated €1.5 billion in 2021.

From 2024 the entry into force of a new withholding tax on dividends will reduce these money flows even further. This was set out in a letter submitted to parliament today by the State Secretary for Tax Affairs and the Tax Administration Marnix van Rij. The letter details the effects of several measures, based on the figures provided by the Dutch central bank (DNB). These figures are provisional in nature and were calculated in part using forecasts based on past data.

‘The issue of tax avoidance via the Netherlands has been successfully tackled using a range of measures, including the introduction of a withholding tax on interest and royalties from 2021 onwards,’ said the State Secretary. ‘There has been a significant reduction in funds flowing through the Netherlands to low-tax jurisdictions. But our fight against tax avoidance is not over. There are still too many letterbox companies in the Netherlands. In the period ahead, the government wants to continue working with other countries in order to further combat abusive arrangements involving conduit companies. That's why we’re doing all we can to ensure the success of the proposal that has been put forward by the European Commission in this regard.’

From 2021, the withholding tax on interest and royalties has enabled the Netherlands to tax payments to countries that levy too little tax or none at all. The measure applies to payments to countries with a corporate tax rate of under 9% and to countries on the EU list of non-cooperative jurisdictions. The withholding tax can also be applied in situations of tax abuse. As of 2024 the scope of the withholding tax will be extended. As of then dividend payments will also be subject to the withholding tax.

In addition to keeping track of financial flows to low-tax countries, the actual tax return data for the withholding tax is also being monitored. In 2021, €51 million was paid in withholding tax, while the government had not forecast any revenue. This tax revenue is due in part to the fact that companies did not adapt their structures in time. It could also be that in some cases companies preferred to pay the withholding tax than bear the high costs associated with reorganisation. The remaining flows of interest and royalties to low-tax jurisdictions (and the corresponding tax revenue) are still expected to disappear in the long run.

An assessment has also been made of whether the withholding tax in the Netherlands has shifted the money flows to other conduit countries, like Singapore and Hong Kong. Currently there is no reason to assume this is the case.

In the period ahead, the government's approach to tackling tax avoidance will focus on additional international measures, implementing international agreements on a minimum tax rate and the European Commission's proposal to counteract abuse of conduit companies. All of these measures will make the Netherlands even less attractive to letterbox companies. The Netherlands will continue to annually monitor developments on combating tax avoidance.