Netherlands leads the way in Europe with bill for the Minimum Tax Rate Act 2024 (implementing ‘Pillar Two’)

The bill for the proposed Minimum Tax Rate Act 2024 was presented today to the House of Representatives of the Dutch parliament. The proposal ensures that multinational groups and domestic groups with an annual revenue of €750 million or more pay tax on their profits at an effective rate of at least 15%. By introducing this legislation the Netherlands is implementing an international agreement concluded in October 2021 by 138 countries. This is an important measure to counter tax avoidance worldwide. The Netherlands is leading the way in the EU with the bill presented to parliament today.

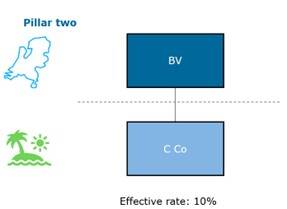

Companies will only pay the new top-up tax if the group to which they belong pays a corporate income tax at an effective rate that is lower than the minimum tax rate. This will be determined by deducting the effective tax rate calculated for that state from the minimum tax rate of 15%. The minimum tax rate of 15% has been agreed internationally. The following simplified example shows how the primary measure works:

The company ‘C Co’ has an effective rate of 10%. It is part of a group of which the parent company is established in the Netherlands (‘BV’). As there is a positive difference of 5% (i.e. minimum tax rate of 15 % minus the effective tax rate of 10 %), C Co is a low-taxed entity and therefore the Pillar Two rules apply. This means that BV is subject to a 5% top-up tax on C Co’s profit.

Less profit shifting

This bill reduces the incentive for companies to shift profits to low-tax countries. The bill is also intended to put a floor on competition between states over corporate income tax rates. This should prevent a race to the bottom in corporate tax and, in addition, level the playing field for multinationals.

‘I applaud this new step, which will result in a global approach to tackle tax avoidance,’ said Marnix van Rij, State Secretary for Tax Affairs and the Tax Administration. ‘Tackling tax avoidance is a priority for me. Because of tax avoidance, the cost of funding public services is borne entirely by individuals and companies who do pay their tax. This is unjust, especially since those companies who avoid taxes still benefit from services funded by taxation.’

Background

A global minimum level of taxation (Pillar Two) is part of the OECD agreement on the reform of the international tax system, to which 138 countries have signed up. The European Commission proposed a directive on implementing this minimum level of taxation in the EU. EU member states reached unanimous agreement on this proposal on 15 December 2022. Member States are obligated to implement the directive in their national legislation by 31 December 2023. The Netherlands has launched an online consultation on the draft implementation bill at the end of 2022. After the responses to this consultation had been processed, the bill was submitted to the Council of State for an advisory opinion.

The bill will be debated by the House of Representatives in the coming months, and then by the Dutch Senate. The bill is expected to enter into force on 31 December 2023. The Tax Administration will strive to effectively implement the new rules into practice.