Budget Memorandum 2013: Shock-proof government finances and a resilient economy

The Netherlands is a prosperous country, but as a result of two recessions in four years the economy has suffered. In the years to come the economy is expected to grow again, although growth will be lower than in the years before the crisis due to the ageing population. At the same time, new setbacks as a result of continuing uncertainties in the international economy and the world-wide financial system cannot be ruled out. Therefore, the Netherlands has to achieve sound government finances as part of a shock-proof and resilient economy, according to the government in the Budget Memorandum 2013.

Today, on Budget Day, Minister of Finance Jan Kees de Jager has presented the budget to the Lower House of Parliament. “The credit and debt crises have affected the economy and government finances, like continuing high water affects dykes. Repair and reinforcement cannot be postponed. In order to better withstand a possible next shock in the economy the budget deficit has to be reduced and reforms are needed to strengthen the economy”, according to the Minister in his traditional Budget Day speech to the Lower House.

Budget Agreement

Sound government finances and a resilient economy are the core principles of the Budget Agreement 2013, which was presented in April and served as a solid basis for the 2013 budget. The agreement – in which five parties and the government closely cooperated – has prevented government finances from worsening. The Budget Agreement comprises substantial reforms that improve government finances and strengthen the economic structure, including modernisation of the labour market, accelerated increase of the retirement age and housing market reform. The measures help to maintain high levels of public health care, education, infrastructure and security in the future. It also means that future generations do not have to foot the bill of this crisis.

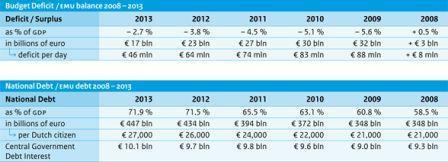

Deficit, debt and interest

The budget deficit is expected to be almost 17 billion euro in 2013. This amount consists of two components: The Central Government has a deficit of 13.5 billion euro and local and regional authorities (municipalities, provinces and water boards) are responsible for 3.2 billion euro of the overall deficit. Expressed as a percentage of gross domestic product (GDP) the deficit next year will be 2.7 percent. This means that, compared to the year 2009, the deficit has more than halved. It also means that the Netherlands complies with the 3 percent reference value of the Stability and Growth Pact. By the end of 2013 government debt is expected to amount to 447 billion euro (71,9 per cent of GDP). To finance the debt 10 billion euro has been earmarked on the 2013 national budget for interest payments.

Vulnerable

Owing to a relatively favourable point of departure – in 2008 the Netherlands had a budget surplus and low debt – the government has managed to soften the blow of the crisis to a large extent. The downside is that government finances have worsened. This makes the Netherlands more vulnerable. Financial buffers are crucial in order to be able to deal with possible new setbacks. Shock-proof government finances also support confidence and therefore economic growth. The government aims at measures to increase the resilience of the government, private households, companies and the financial sector, so that they are better prepared for changing economic situations. The Budget Agreement is an important step in that direction.

Savings according to plan

The Budget Day documents show that the implementation of the savings in the Coalition Agreement (18 billion euro) and the Budget Agreement (12.4 billion euro) is going according to plan. For 2012 savings are planned of 8 billion euro in total. In 2013 this amount will increase to almost 23 billion euro. For both years the measures are either entirely finalised or on schedule and where measures have been replaced or a delay is encountered sufficient financial cover has been provided.