Government to step up fight against tax avoidance with new withholding tax on dividend flows

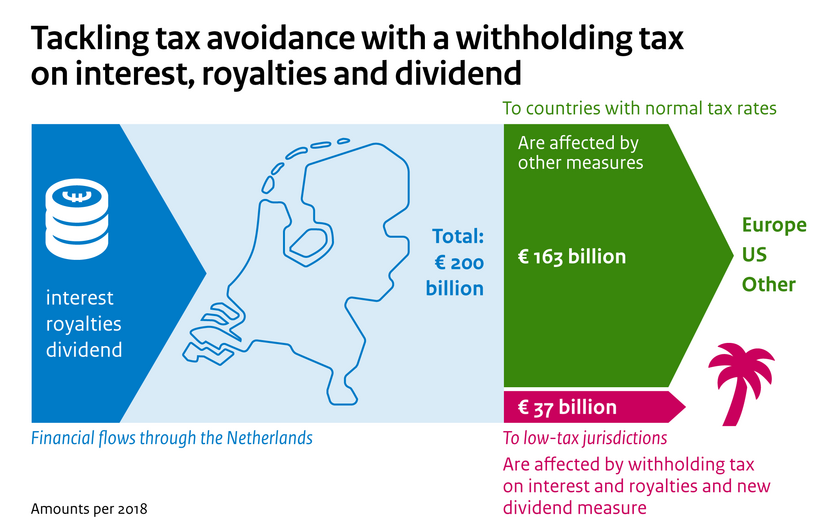

In 2024 the Dutch government is planning to introduce a new withholding tax on dividend flows to low tax jurisdictions. This will mark another big step in the fight against tax avoidance. The new tax will come on top of the withholding tax to be imposed on interest and royalties from 2021.

The new tax will enable the Netherlands to tax dividend payments to countries that levy little or no tax, and will also help curb the use of the Netherlands as a conduit country. The measure will apply to financial flows to countries with a corporate tax rate of under 9% and to countries on the EU blacklist, even if the Netherlands has a tax treaty with them.

As State Secretary for Finance Hans Vijlbrief explains: ‘This additional withholding tax represents another major step in our fight against tax avoidance. Financial flows channelled from or through the Netherlands to another country where they are not or not sufficiently taxed, will soon no longer go untaxed. It’s now vital to make even better international agreements to prevent other countries being used for tax avoidance purposes.’

From 2021 interest and royalties will be subject to a withholding tax. This is one of the measures taken by this government in recent years to tackle tax avoidance. The effects of these measures are monitored wherever possible. This has revealed that, contrary to expectations, there are large dividend flows to countries that levy too little tax.

In 2016 they totalled 35 billion euros, and not 22 billion euros, as announced earlier. The figures for 2018 show that this amount has now risen to nearly 37 billion euros. The reason the initial estimate was too low is that earlier surveys by SEO Amsterdam Economics only looked at dividends paid out from current-year profit, whereas the Dutch central bank (DNB) also tracks retained earnings that may be paid out in later years. The withholding taxes on interest, royalties and dividends will specifically target these financial flows.

Before its term of office ends next March, the government intends to devise measures for taxing dividend flows from 1 January 2024. This will give the Tax and Customs Administration time to prepare for their introduction. Businesses, too, will have time to make the necessary organisational changes.

Tax treaties

In addition, the government has sent parliament a letter on tax treaty policy, expressing the Netherlands’ wish to do even more to take developing countries’ interests into account. Since these countries often have little other tax revenue, it is particularly important that they can levy enough tax on the income generated by activities and investments there.

The Netherlands is therefore willing to make agreements with these countries to give them more taxation rights, including in situations where dividend, interest or royalty payments are made from these countries. For the 47 poorest developing countries, the Netherlands is open to include a ‘source state tax’ on payments for technical services carried out in the developing country. For instance, when a Dutch person carries out a management or consultancy job in a developing country, a tax treaty normally allows tax to be levied only in the Netherlands. The source state tax will also enable the developing country to levy tax.