Dividend withholding tax bill submitted

The bill introducing an additional withholding tax on dividend flows to low-tax countries from 2024 was submitted to the House of Representatives today.

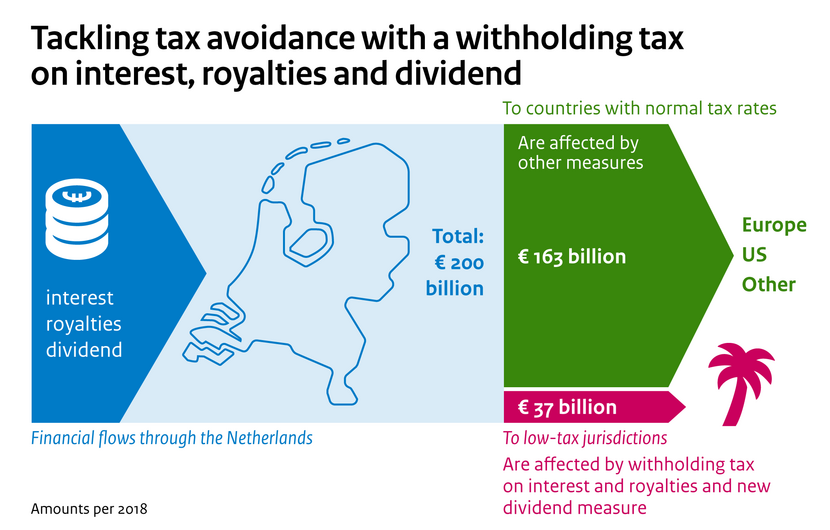

The new tax will enable the Netherlands to tax dividend payments to countries that levy too little or no tax. The measure will apply to dividend flows to countries with a corporate tax rate of under 9% and to countries on the European Union’s list of non-cooperative tax jurisdictions.

‘The Netherlands has radically changed its approach to tackling tax avoidance under the current government,’ State Secretary for Finance Hans Vijlbrief says. ‘The withholding tax on interest and royalties is one of the most important measures. This tax will now also apply to dividends. Financial flows channelled from or through the Netherlands to another country where they are not taxed, will no longer go untaxed. It’s now vital to make even better international agreements to prevent other countries being used for tax avoidance purposes. The Netherlands can take on a leading role in this regard over the coming years.’

The withholding tax comes on top of the withholding tax on interest and royalties, which came into force on 1 January 2021. The bill that has been submitted to the House of Representatives has a similar design. The measure will be introduced in 2024 to give the Tax and Customs Administration enough time to prepare.

These measures specifically target financial flows to low-tax countries, which DNB, the Dutch central bank, estimated to be worth €37 billion in 2018. Since the government expects this bill to put an end to dividend flows from the Netherlands to countries with low tax rates, no estimate has been made of how much revenue this measure will generate.

Monitoring

Flows of income from the Netherlands to low-tax countries are monitored annually. The monitoring data can be used to carry out, in 2023, the first impact assessment of the withholding tax on interest and royalties.

The withholding tax is one of the many different measures which the current government has taken to combat tax avoidance. A complete overview of these measures is available on government.nl